Financial analysts spend hours manually processing reports, analyzing market data, and creating investment recommendations. Financial AI agents automate research, generate insights, and deliver personalized portfolio strategies instantly. By integrating with trading platforms and financial models, these agents refine risk assessments and improve market predictions.

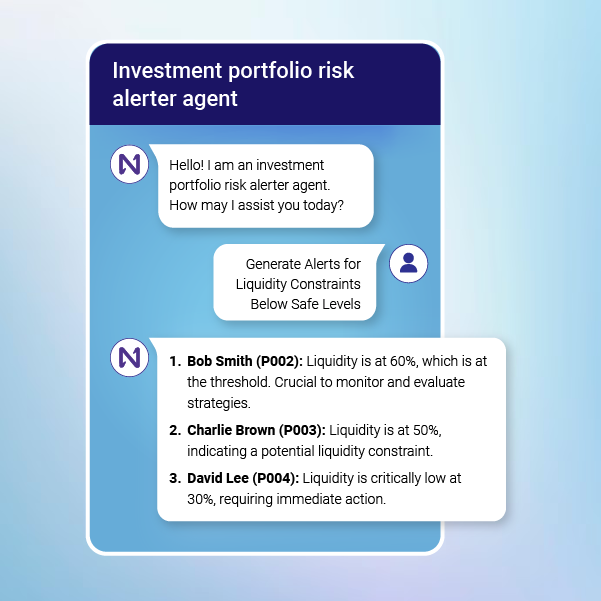

Individual investors, often overwhelmed by the task of monitoring their investment portfolios for risks like over-concentration, market volatility, and economic changes, can now rely on Needle’s AI agents. These agents can continuously monitor portfolios and alert investors to potential risks.

Risk monitoring and Alert generation

Monitor all client portfolios for sector concentration risks, liquidity constraints, and geographical exposure. Alert relationship managers when client portfolios deviate from approved risk thresholds or investment mandates.

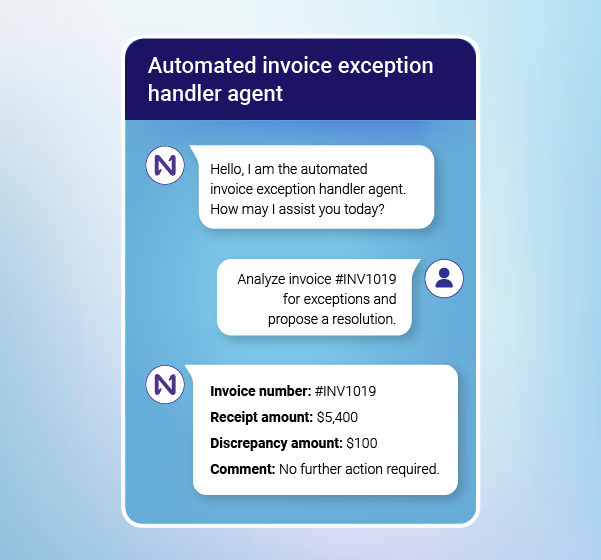

Finance teams spend large time manually reviewing invoices that fail automated matching due to discrepancies between purchase orders, receipts, and invoice amounts. AI agents can investigate and resolve common invoice exceptions using predefined rules and historical data patterns.

Automated analysis and Resolution

Automatically process and resolve common invoice exceptions across all departments based on company policies. Flag only cases requiring human review, with suggested resolutions based on historical patterns.

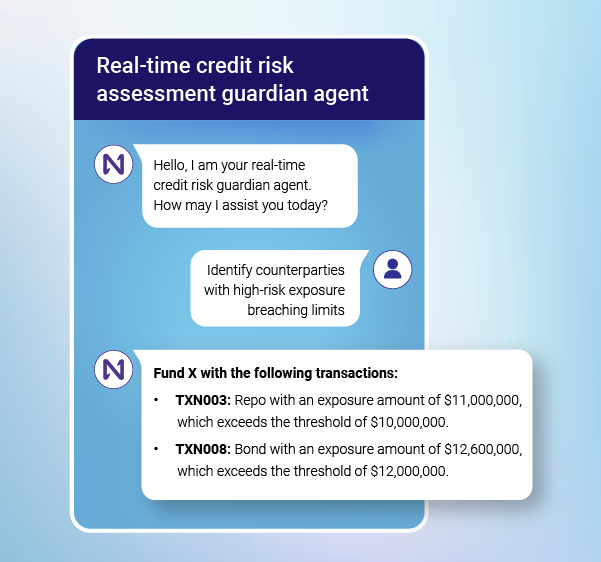

Treasury departments can proactively manage counterparty credit exposure across multiple financial instruments with the real-time monitoring and AI agents’ alerting capabilities. These agents can track exposure levels, alert on threshold breaches, and suggest rebalancing actions.

Continuous monitoring and Alert generation

Track aggregate credit exposure across all business units and financial products. Generate alerts for risk committee review when institutional client exposure approaches internal limits or regulatory thresholds.

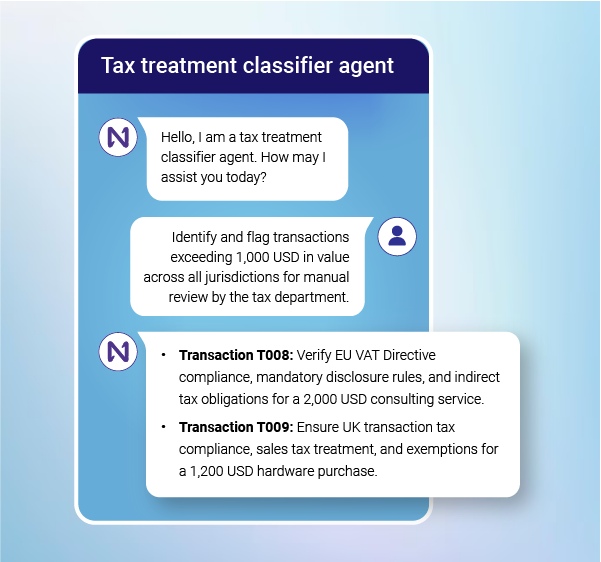

Finance teams struggle with correctly classifying transactions for tax purposes across multiple jurisdictions. AI agents produced by Needle can analyze transaction details to determine appropriate tax treatment and compliance requirements.

Classification and Validation

Automatically classify tax implications for all client transactions across multiple jurisdictions. Ensure compliance with current tax regulations and flag complex scenarios for tax department review.

Choose us and experience the difference. We leverage the power of GenAI-powered solutions to enable you to craft personalized journeys that resonate with every customer. This drives engagement and ignites brand loyalty. Get expert guidance, seamless integration, and a strategic approach to transform your business processes.

Get AI-driven insights and real-time risk monitoring with Needle’s customizable finance AI agents.

by submitting this form you agree with the terms and privacy policy of Softweb Solutions Inc