Customer Background

Our client, a leading health insurance provider, offers comprehensive health benefits to individuals and businesses, ensuring affordable coverage, simplified healthcare experiences, and access to high-quality care. With a focus on protection, our client offers a wide range of insurance products and services to individuals and businesses worldwide.

-

Industry

Insurance

-

Technologies / Platforms / Frameworks

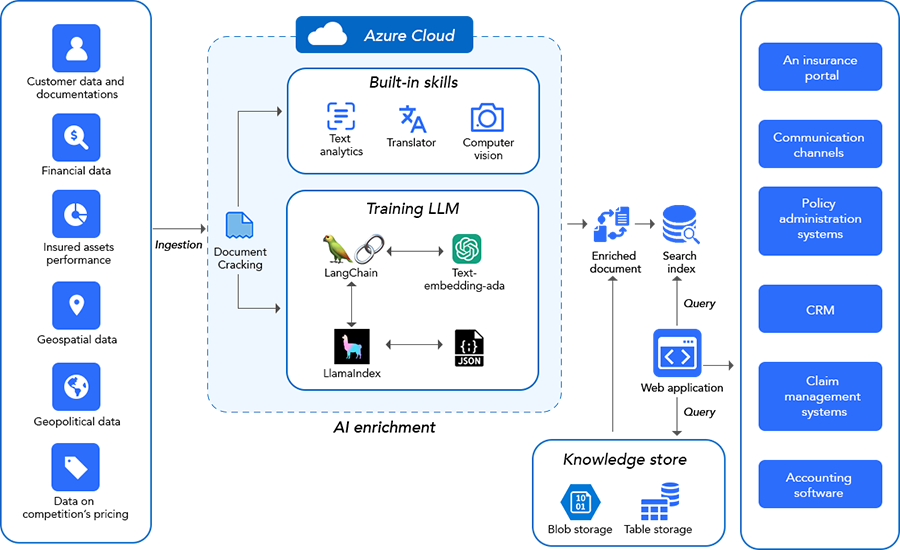

Generative AI, NLP, LLM, LangChain, Azure Open AI

Challenges

Our client, a global insurance company, faced challenges with claims processing, managing network providers, detecting frauds and engaging customers. Due to these issues, they failed to optimally manage their operations and provide seamless services for a better customer experience.

The client faced several challenges in managing their insurance operations, including:

- Complex claims processing: The client received a high volume of claims each day and processing them was complex and time-consuming. This led to delays in payments, which frustrated customers.

- Inefficient provider network management: The client had a large network of hospitals and doctors, but it was difficult to keep track of all of them. This made it difficult to ensure that customers had access to the care they needed, which also led to increased costs.

- Inaccurate fraud detection: The client was concerned about fraud and abuse in their claims process. They lacked the tools to effectively detect and prevent fraud, which resulted in financial losses.

- Personalization gap in member engagement: The client wanted to improve member engagement by providing personalized healthcare recommendations and proactive health management. However, they lacked the resources to do this at scale.

They were looking for an artificial intelligence powered solution to address these challenges, so that they can optimize processes, enhance customer satisfaction and position themselves as industry leaders.

Solutions

Softweb Solutions closely collaborated with the client to understand the urgency and complexity of the challenges. Our team used a consultative collaborative approach to identify the business pain points and implement generative AI solutions customized as per the client’s business needs.

Our generative AI solutions included –

Intelligent claims processing:

The intelligent claims processing solution that Softweb offered uses NLP to extract key information from claims forms and compare it to policy data. This information is then used to automatically verify claims and identify any potential fraud. As a result, this process has significantly reduced the time and effort needed to process claims while delivering improved accuracy.

Simplified provider network management:

By integrating AI technology, the management of the vast healthcare provider network became more efficient. This resulted in easier access to healthcare services for customers and better ways to control costs.

Accurate fraud detection:

By using artificial intelligence, our client can identify people trying to defraud their system and prevent fraud. With a generative AI application, they can detect unusual claims, find fraudulent techniques, and get notifications to prevent fraud.

Personalized life insurance solutions:

Softweb Solutions integrated generative AI models into our client’s CRM platform, enabling them to use customer data to generate personalized life insurance recommendations. This data includes factors such as the customer’s age, financial goals, and risk profile. The solution then uses this data to recommend the best life insurance policy for the customer. This solution has helped the client to increase policy adoption and improve customer satisfaction.

Advanced asset management:

By integrating generative AI into the client’s asset management system, we facilitated the provision of personalized insurance policies. Analyzing market data, the AI solution showed investment opportunities using historical trends, current economic conditions, and individual goals, thus optimizing investment strategies and yielding superior returns.

- 30%

reduction in claims processing time

- 20%

increase in policy adoption

- 15%

increase in investment returns

Need more information?

Tell us what you are looking for and we will get back to you right away!