Imagine your data not just sitting idle but moving forward to profit and expansion. That’s the power of data monetization, where raw information transforms into a thriving marketplace. Enterprises tap into this potential by offering data insights, analytics, and even raw data itself to a diverse audience – partners, researchers, and even new-age companies. And the proof is in the numbers: a Melbourne business school study shows data-monetization pioneers generating a staggering 60% more revenue than their hesitant counterparts.

Insights gleaned from Deloitte’s 2023 global technology leadership study reveal a compelling narrative:

1. Current revenue generation: Currently, 36% of executives have successfully used revenue streams through the sale of data, technology, or tech-centric services.

2. Upcoming ventures: In a forward-looking move, an additional 16% of executives are gearing up to venture into this lucrative space within the next two years.

3. Future projections: The data market is poised for a meteoric rise, with predictions estimating its value to skyrocket to USD 15.5 billion by 2030. This projection signifies an impressive Compound Annual Growth Rate (CAGR) of 22.1%, underlining the sector’s potential for exponential growth in the coming decade.

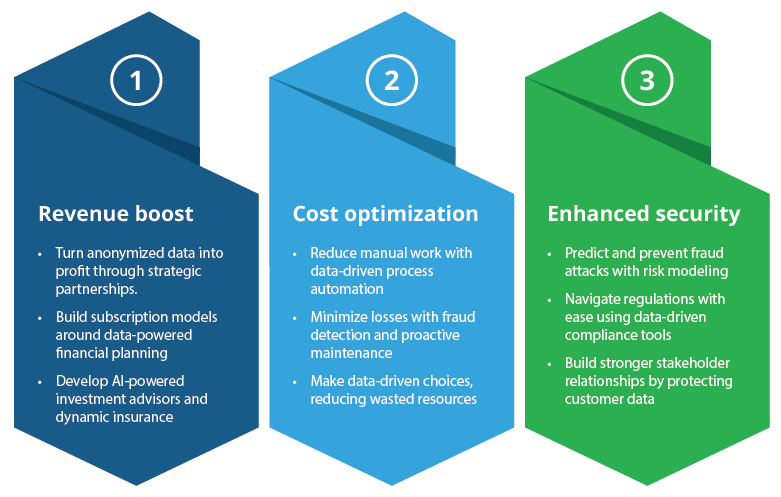

Why is data monetization not merely an option, but a necessity?

Unearthing hidden gems: Financial institutes alone sit on an exabyte of data – five times the collective wisdom of humanity’s spoken word. Yet, the true value of this trove often lies buried, unseen. CFOs must become prospectors, sifting through transaction patterns, payment preferences, and location data like seasoned miners panning for gold. But like any valuable resource, data has its own metadata – the map that reveals its true meaning. Understanding data quality, storage, and context through quantitative and qualitative tools, including public sentiment reports and tech trend surveys, is crucial to unearthing these hidden gems.

Meeting modern needs: Today’s consumers crave hyper-personalized, tech-driven experiences, especially in the realm of banking. By effectively monetizing data, finance leaders can cater to these evolving needs, crafting seamless experiences that not only generate revenue but also foster customer loyalty. Artificial intelligence becomes the alchemist in this equation, transforming raw data into predictive insights that fuel the development of innovative products and services, anticipating needs before they even arise.

Investing in the future: Data monetization isn’t just a quick buck; it’s a foundation for long-term resilience. Generic consulting playbooks won’t do. Financial organizations must craft bespoke strategies that align with their unique people, processes, technologies, and desired outcomes. This means scrutinizing every step of the data journey – from who utilizes it to how it’s stored and shared. Cloud infrastructure, single-view capabilities, and real-time dashboards become the instruments in this orchestra, ensuring CFOs stay ahead of the curve and anticipate market shifts before they become tidal waves.

Data is the fuel that propels modern businesses, and for CFOs in the finance industry, it’s not just essential; it’s the rocket engine. Monetizing the right data translates to meeting customer needs, staying at the forefront of tech, and building a future-proof enterprise that can weather any storm. So, business leaders, it’s time to grab your shovels, sharpen your analytical tools, and embark on a data-driven odyssey. The buried treasure awaits, promising not just profit, but progress for an industry poised to reshape the very fabric of finance.

Turn data into dollars. See how our dashboards transform information into tangible business wins

Why higher-priced data assets require a more nuanced sales approach

Higher-priced data assets, much like marketing a rare diamond, demand a nuanced sales approach. Recognizing the strategic importance of monetizing data in the financial industry, CFOs are encouraged to ensure their data’s value aligns seamlessly with their organizational goals. This means deeper customer engagement, often involving multiple touchpoints and a focused, one-on-one approach.

Lower-priced assets: marketing takes the lead

Lower-priced data assets follow a different strategy, where marketing takes the lead. Picture it as managing a bustling marketplace. Clear branding, engaging content and easy-to-use platforms guide customers through the buying journey. They research, evaluate and purchase independently, generating revenue through sheer volume. This approach emphasizes the importance of effective marketing and user-friendly platforms when dealing with more accessible data offerings, ensuring a seamless and efficient buying experience for customers in the finance industry.

Choosing the right model for your data monetization

Each model holds unique advantages. Selecting the best one depends on your business goals and data assets. Here’s a quick guide:

| Data Monetization Model | Revenue Model | Data Requirements | Implementation Complexity |

| Commercialization | Direct data sales, subscriptions | Highly valuable, structured data | High (marketplace setup, marketing) |

| Operational Improvements | Increased efficiency, cost savings | Internal operational data | Moderate (data analysis tools, training) |

| Partner Sharing | Shared insights, collaborative projects | Mutually beneficial data sets | Low (data sharing agreements, security protocols) |

| Innovation | New products, services, processes | Diverse data sources, unstructured data | Moderate to high (data collection, analytics expertise) |