Goal of any financial institution/investment manager: Deliver asymmetric returns!

Method: Fastest access to data or information to make smarter, quick investment decisions.

In 1985, being able to access and process the price-to-book (P/B) ratio for every S&P 500 stock was an edge. Today, anyone with an internet connection, which is 5.3 billion people (according to Statista), can access this data. Calculating basic financial ratios for stocks is no longer an edge. Of course, not everyone with an internet connection can manage funds trying to beat the S&P 500. Clearly, data access is no longer an edge. Effective analysis is.

If a retail investor wants to buy 100 shares of Microsoft, anyone can do it instantly at a price anyone sees on the screen. The liquidity has grown phenomenally with digital transformation. But if you want to buy a million shares of Microsoft, that’s another story. The challenge is for institutional investors who try trading large volumes across portfolios and asset classes.

Keeping such objectives and target audience in mind, we have created this blog for:

- Decision makers with the responsibility to develop and implement their companies’ artificial intelligence (AI) and big data strategies. They can realize AI’s potential in investment management and establish strategic directions.

- Knowledge engineers who lead AI and big data projects at investment firms, securities brokers and dealers, hedge funds, or any key participants in the securities markets and their teams choose projects.

- Investmernt and technology leaders or professionals who work in T-shaped teams with an understanding of AI in investment management project and implementation in detail.

- Regulators who want to keep up with industry developments to help them develop policies that can detect fraud, prevent wrongdoing and ultimately protect investors.

What makes AI special for investment management?

The computer geeks are taking over Wall Street. The world’s top hedge funds made record profits last year as stock markets recovered. According to LCH Investments research, the fund management industry made $218 billion in gains after fees in 2023 – the industry’s highest-ever gains after systematic investing began.

Amongst it, Citadel LLC has generated $74 billion in net profits since its inception in 1990. It is the most successful hedge fund in history. One of the most likely contributors to these massive gains is data scientists’ and analysts’ use of machines’ ability to forecast markets.

With today’s trading taking place in microseconds in a market dominated by computerized and automated trading, relying on the human eye to spot opportunities or problems is not sufficient. Small misses or mistakes can quickly turn into big regrets.

Did you know:

- Citadel uses AI to identify potential opportunities.

- We have had $9 trillion of money now into market funds.

- JPMorgan dedicated 50,000 people and $10.8 billion to explore AI’s use in finance.

- The Securities and Exchange Commission (SEC) ‘s Consolidated Audit Trail (CAT) receives 418 billion records per day.

It makes the CAT the world’s largest data repository for information on securities transactions. The CAT tracks orders throughout their life cycle, from order entry to trade execution. It also identifies brokers involved in the orders and helps reveal misconduct. With AI in trading, the CAT can transform money market surveillance and our understanding of the market in the same way the Hubble Space Telescope transformed our view of the universe.

Our financial markets require two things to function correctly: trust and information. Timely information and execution build trust. That’s why AI in investment management captivates decision-makers, knowledge engineers, technology leaders, and regulators.

Suggested: Imagine the possibilities as we transition from the data rush to data wars. Are you curious about how you can harness the power of a data revolution in financial markets? Discover the five tips to implement AI in your organization by clicking here!

Applications of AI in investment management

Let’s break down the applications of AI in investment management into two practical categories:

- Enterprise-facing applications of AI in investment management, and

- Customer-facing application of AI in investment management

Three key enterprise-facing applications of AI in investment management

Research by leading financial institutes shows that sentiment analysis, topic modeling or summarization, and question-answering projects have the highest probability of success in large enterprises because they address common inefficiencies or manual processes.

Decipher sentiment in social media posts

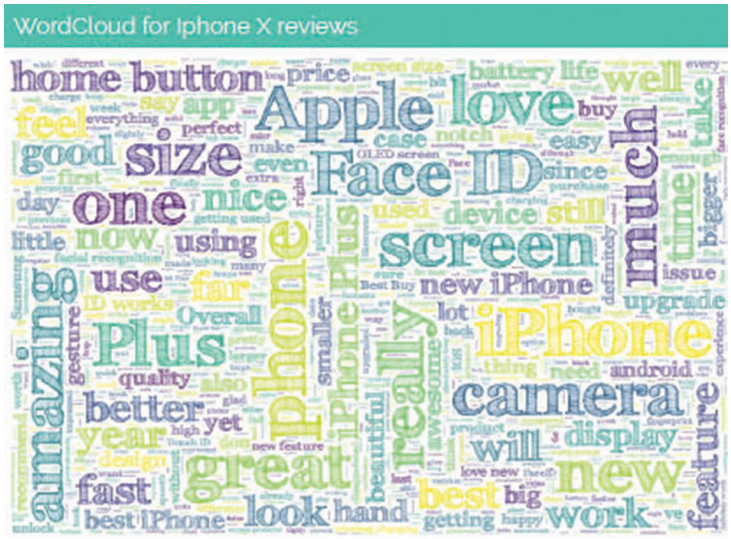

When the iPhone X launched in 2017, investors turned to social media to gauge its reception. They wanted to know if consumers valued its new features, such as Face ID and no home button.

One common approach was to scrape smartphone reviews from various websites and use word clouds to uncover key topics and themes. In the figure below, larger words in reviews show frequency. While some words do not mean much (‘much’ and ‘use’) or expected (‘Apple’), ‘Face ID’ was highlighted in reviews. Also, people used ‘love’ and ‘amazing’ words to describe the new phone.

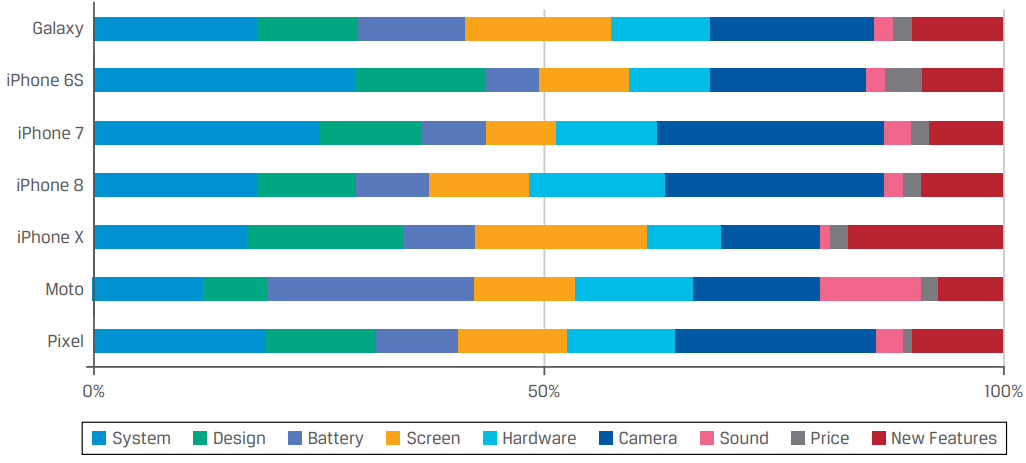

Investors analyzed prevalent features in reviews to assess the iPhone X’s new features and their potential to drive adoption, as shown in the following figure. This involved identifying key differentiators (system, screen, battery, price) and relevant keywords. The highest positive reviews of iPhone X’s new features confirmed strong consumer appeal and gave investors confidence.

This example serves as a tangible demonstration of how natural language processing (NLP) analysis is applied in the real world. NLP, a subfield of AI, equips computers with the ability to understand and generate human language. This technology is not just a theoretical concept, but a practical tool that ingests social media and review data to provide valuable investment insights. In 2017, investors put NLP to use, monitoring the launch of iPhone X and using aggregated social media posts to gauge positive adoption. The outcome was a conclusion that the new phone was likely to replicate the success of its predecessors.

Suggested: Want to know as exciting as how deciphering sentiment through social media posts can help in investment decision-making? Check out how autonomous AI agents revolutionize financial services!

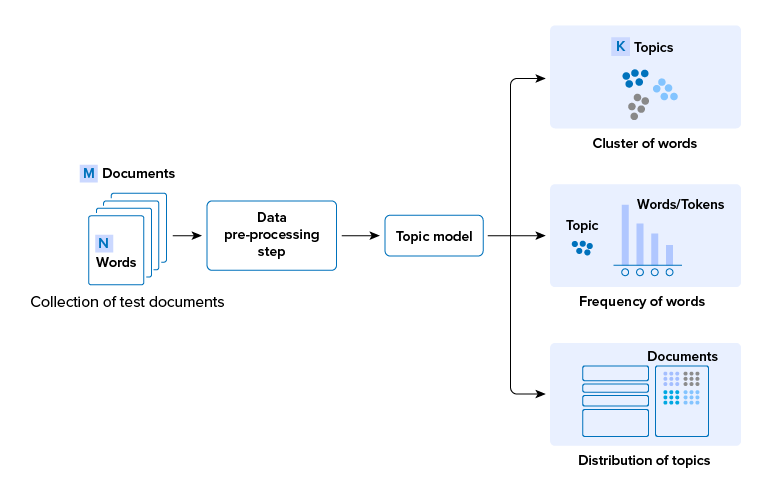

Extract themes to highlight important topics and trends

The investment industry deals with vast amounts of documents. Often, analysts go through these documents to synthesize and summarize or extract critical sections or figures. The following figure outlines how AI can help synthesize or summarize large documents.

Topic modeling, a technique that identifies key themes in documents, is a valuable tool for any industry. For instance, you are a foreign investor who wants to invest in India’s semiconductor industry. Technology service providers like us can train your team to apply BERTopic, a specific topic modeling technique, to analyze over 300,000 production records of semiconductor chips in India from June 2021 to June 2024. This will enable you to extract the most relevant themes and topics from the text, providing valuable insights into evolving trends and themes’ temporal significance. The themes inferred from news articles, magazine articles, or shareholder letters could range from the following:

- Development of semiconductor design and manufacturing capabilities

- The production of lithographic components for semiconductor

- The growth of the semiconductor wafer fabrication industry

- The establishment of R&D centers in India to support the manufacturing of semiconductor chips

- Government of India’s policies and initiatives to support the growth of the semiconductor industry

Each theme can have multiple topics. Topic modeling is a powerful tool for uncovering key themes or ideas across documents. It also tracks topic evolution over time, revealing their significance. In the context of the fund management industry, for example, investors can extract key themes and associated keywords from a vast amount of documents. This can provide them with informed perspectives and aid in investment decision-making.

Get answers at your fingertips from the large corpus of documents

The question-answering (QA) system has broad applications across the fund management industry. Research analysts, risk managers, compliance officers, and operations staff constantly scour documents for key figures and specific items within documents. Examples include:

- ESG monitoring

- Financial statement analysis

- Regulatory reporting, and

- Fund prospectus reviews

Imagine the speed they get using the question-answering system. The QA system is designed for exactly this purpose. The goal of QA is to build systems that automatically extract answers from a given corpus for questions posed by humans in natural language.

Biggest customer-facing application of AI in investment management – intelligent customer service (ICS)

Regardless of your sector – insurance, banking, securities, or internet finance – ICS is a versatile solution that can enhance your operations in multiple ways. For instance,

- The insurance sector can increase customer retention and conversion.

- During peak periods, the internet finance sector can handle personalized customer service.

- The banking sector can handle highly repetitive queries and focus on smart marketing.

- The securities sector can increase push services and also enable customers to select and analyze stocks smartly.

Any SME or a large enterprise will need a knowledge management platform while building an ICS. The knowledge management platform can support multiple customer-facing applications. It will also serve as a centralized maintenance system for an SME or a large enterprise. Hence, it reduces repeat purchases and investments while lowering costs and increasing efficiency.

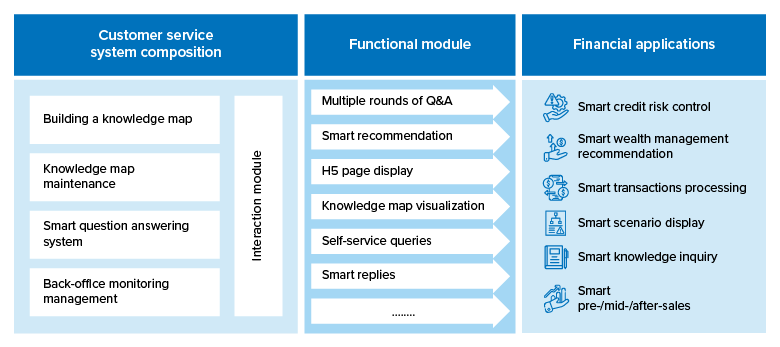

The image given above depicts a typical ICS architecture. It has five components: interactions, graph construction, knowledge graph maintenance, intelligent QA system, and back-end management. The interactions module supports additional functions like multi-round Q&A, smart recommendations, H5 page displays, knowledge graph visualization, self-service queries and intelligent replies. By combining various functions and embedded interactive formats, you can have multiple AI-enabled financial applications, such as credit risk control, financial management advice, business processing, scenario display, knowledge search, presales, sales, and post-sales.

At last

Whether you are a decision-maker, knowledge engineer, investment and technology leader, or regulator, we can help you build such an intelligent process and deploy it through public cloud, hybrid cloud, or private deployment. We also have expertise in developing and deploying enterprise-facing AI applications in investment management. Applying such AI applications gives you effective analysis and an edge.