Do you remember how the financial organizations were working before the introduction of mobile devices? Operations in the financial industry were completely different when there were no mobile devices and applications available in the market. It was quite difficult for financial organization to build strong relationship with their customers and get instant feedback from them.

Customers can only get the information about their transactions only when they meet with executives of the enterprises. Due to information gap, customers are unable to know about their financial savings and schemes. Opening an account in the bank was not an easy task. To open an account in the bank, a big procedure was followed like a customer visit to the bank, fill the form for opening an account, and submit the required documents.

Sometimes, customers get the idea of the sort of documents that needs to be submitted only when they come to the bank premises or else they might have forgotten to bring those docs. This long procedure has been a just a waste of time for customers. Customers have to take out special time to access financial services. They have to go at specific locations to access these services. Organizations had to spend a lot of money to remain connected with their customers. Companies have to pay courier charges, printing charges etc., for their businesses. Apart from this, working style was lengthy and this leads to slow productivity. All the tasks were done manually. More paperwork was done. Lack of security and reliability of data was also a great concern there. These all problems were solved after the arrival of mobile devices (Mobility Solutions).

The financial organizations: Questions arise before using mobile technologies

The financial organizations will have a few questions that needed to be answered before implementing any mobile solutions such as how the productivity of the employees is going to be improved, how it enhance the customer satisfaction, and what kind of mobile applications will be appropriate enough to enhance the financial services productivity and thereby improve the return on investments. Also, there is a great concern over the security as the data are highly sensitive and needs to be protected effectively. Hence, the financial organizations seek very secure mobile applications before adopting any sort of mobile technology into their organizational workflow.

Introduction of mobility in financial sector

The mobility solutions have changed the working style of financial industry by removing traditional methods of working. With changing time, enterprises need to remain connected with the world. Mobility helps financial service industry to speed up the processes. The main intention of the finance organization behind using mobility solution is to meet their customer expectations and at the same time reducing the cost by minimizing, the expenses involved in carrying out day–to-day transactions manually.

Mobility automates the transaction process, which does not require human participation at all. Customers have become more comfortable with undertaking basic financial services on their mobile devices. The financial service organizations have to make sure that their wealth management, capital market, banking or e-commerce transactions can be done at the right time on any mobile devices from anywhere in the world. Nowadays, customers are also looking for reliable and effective financial services where they can invest their money in order to grow while having a complete control over it. Also, they want their funds to help them in uncertain economic conditions.

Mobility solutions are not only helped the customers, but also helped banks to invest in new opportunities and find out different ways to build healthy relationships with customers and improves the efficiency of their employees by allowing them to work from anywhere (BYOD).

Customers having mobile devices in their hands always expect personal attention and fast response. Mobile applications have not only provided new ways to interact and connect with the customers, but it also improved the performance of finance organizations as well. In this ever-changing world, all the financial organizations, whether it is a bank or loan providing company, need a high-powered Financial & Accounting app to stay competitive in the financial market.

Mobility brings change in financial services

Mobile means no more waiting. Using mobile devices, customers save a lot of time and money. They can transfer their money into different bank accounts without going to the bank. They remain aware of the current balance available in their account. They can get alerts about new schemes and savings. They can also get immediate alerts about any transaction done from their bank accounts. They can make payments to anyone with the help of mobile devices. In short, customers remain updated with each and every activity related to their finance without going anywhere. Earlier, when a customer wants to do any bank operation, then he has to go to the specific bank in which he has his account, need to wait in line until his turn comes and also has to travel a lot as bank branches were available in limited areas. Now, the time has changed as the customer can operate in multiple banks from anywhere without travelling and waiting in the line. Mobility solutions are used to connect customers, employees, businesses, and machines.

With the Implementation of mobile technologies, enterprises have become more comfortable in communicating with their customers. They just used to dial the number of their customers or send SMS about their services to remain connected with their customers. Earlier, enterprises had to send their staff to the customer’s place to get their feedback, which was very time-consuming as well as expensive. Sometimes, it is also possible that staff gives wrong feedback to the enterprises or they are not trustworthy. This causes immense loss to the enterprises. In such scenarios, mobile devices are playing a greater role as it enables more secure and trustworthy transactions in the financial organizations. Sometimes, delay in data delivery is also possible due to lack of network traffic. In this case, financial organizations must take care of the speed and reliability of the data as well as quality of services while delivering data to their customers. Customers are more benefited from mobile devices as they can access services on the move.

Benefits

- Improve operational efficiencies

- Access real time information

- Taking quick decisions on real time information

- Fast communication

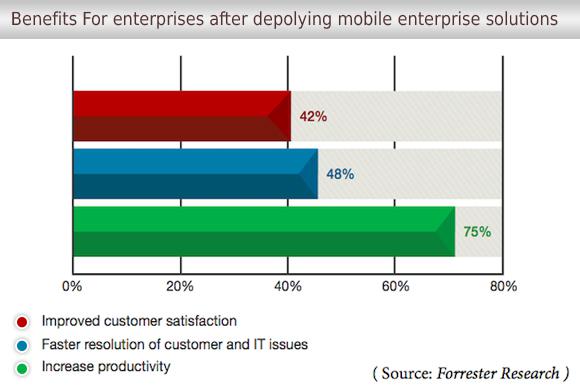

- Improve productivity of the employees

- Meet the customer’s needs

- Response time becomes faster

- Save money and hence more ROI for the financial organizations

- Financial services representatives can easily find out the customer account details, transaction history etc. while meeting with the customers out of the office

- Reduce unnecessary expenses like printing documents, mailing documents to customers

- Reduce paperwork

- You can access data anytime, anywhere in the world. This helps executives to review and approve the financial transactions on the way or on the road.

- Easily scan or import documents like loan papers, forms etc. through mobile devices connected to the organizational network. This helps financial services representatives to process customer data quickly.

- Increases cost saving of the financial companies

- Enhance customer engagement

Conclusion

Finally, the right mobile solutions will enable the financial organization to secure the data and make the business better. Mobility in the financial sector will not only keep your data secure, but will also it propel your company forward as a leading mobile enabled firm, allowing both executives and the business for a large to achieve increased productivity, efficiency, and better business.